There is currently a very sensational lawsuit playing out in a Georgia court that private investigators (PIs) everywhere may find of interest.

This case has it all!

A hard-charging personal injury attorney, an aggrieved plaintiff who has been “severely” harmed by the actions of an insurance company, its defense lawyers, a private investigation firm, and five private investigators individually—and a demand for, you read that right, over 13 billion dollars.

While some observers may find the amount demanded to be over the top— this case is of particular interest to private investigators because it centers on a key liability exposure that PIs face on a regular basis in their line of work: the allegation of “invasion of privacy” and “trespass.”

PIs face this risk (legal exposure) across a variety of assignments—insurance fraud investigations, fidelity investigations, corporate investigations, workplace investigations, and more. The “investigated” party usually has every reason to get the evidence dismissed (if applicable), lash out at the PI, and even sue— if they can.

This case (Mezquital v. American Family Insurance et al) is a perfect example of how an investigation assignment can go very wrong (fast!) and result in serious litigation against the private investigator, their client, and their client’s client! But it is also instructive as a cautionary tale for PIs on what they can do, what they should avoid, and how they can protect their businesses and stay out of trouble.

Here’s the story.

Backstory

In late 2012, Luisa Cruz Mezquital was driving a minivan when a Jeep Wrangler swerved into her lane, hitting her vehicle head on. Her left, dominant hand suffered a degloving injury. There was a substantial loss of skin, muscle, and nerves—leaving her hand permanently disfigured and with a limited range of motion.

American Family Insurance (AmFam), the insurer for the driver of the Jeep Wrangler, misjudged the case. They declined to settle for the policy limits of $100,000 and ended up defending their insured in front of a jury where Cruz was awarded over $30 million for general damages and medical expenses in 2014. AmFam successfully appealed the $30 million verdict and over the next few years fought both Cruz and their own insured in court.

Initial Case Settled

After fighting to throw out the initial verdict and retry the case, the law firm representing AmFam—Baker, Donelson, Bearman, Caldwell and Berkowitz (Baker Donelson)—hired Martinelli Investigations, Inc. (Martinelli) to surveil Cruz; hoping to gather information they could use in their ongoing litigation.

After being engaged by Baker Donelson, the Martinelli private investigators began an incredibly intensive surveillance operation over a span of three weeks. Cruz ultimately discovered that Martinelli was surveilling her and immediately called an emergency hearing with the court—demanding that Baker Donelson produce the surveillance and make the Martinelli investigators available for depositions. After emergency depositions and a review of the videos and photographs, it became clear the PIs had routinely been on Cruz’s private property and put GPS trackers on her car while on her property. Cruz then successfully got much of the evidence Martinelli collected thrown out by the court.

On the eve of the retrial in late 2019, after years of litigation, AmFam settled the matter with Cruz for $11 million. The catch is that Cruz’s lawyer, Ben Brodhead of Brodhead Law, worded the “release of liability,” which Cruz signed as a condition of receiving the $11 million, in a way where Cruz did not release AmFam (or anyone) for any wrongs or damages related to the invasion of privacy or trespass claims she was planning to bring.

New Demand

The result of Brodhead’s clever release of liability is that on the same day that Cruz signed the release, Brodhead sent “preservation of evidence letters” to all parties related to the alleged unlawful surveillance. A year later, Brodhead sent a demand letter to AmFam demanding $50 million to “settle the claims of invasion of privacy and intentional infliction of emotional distress” related to Martinelli’s investigation tactics.

Trespass and Privacy Lawsuit

Cruz subsequently sued AmFam (the insurance company), Martinelli (the private investigation firm), and Baker Donelson (the law firm that hired the investigators), as well as five other private investigators who worked for Martinelli—alleging that all defendants committed crimes and intentional torts “with the specific intent, purpose, and result of causing severe emotional distress, fear, intimidation, and harm” to Cruz.

Cruz’s case rests heavily on the fact that the Martinelli investigators allegedly trespassed onto her property. This stems from the fact that Cruz’s home is accessible via a dirt road that continues on past her property but which is nonetheless included within her property lines. (See Figure 1 for an approximation of the property lines.)

The private investigators involved in the case admitted in their depositions that they had not reviewed the property lines for Cruz’s property and had assumed that the dirt road was not included in her property. They further assumed that the area of land on the other side of the dirt road opposite Cruz’s home was not her property.

These two assumptions turned out to be extremely detrimental to their investigation and are at the root of Cruz’s claims. Cruz argues that these allegations, if proven, “would establish that Martinelli committed multiple felonies.”

Outside of the offhand allegation that the PIs acted inappropriately by briefly surveilling Cruz’s 17-year-old son even when they knew she was not present, the core of Cruz’s lawsuit rests on the following facts:

1. The GPS trackers placed on Cruz’s vehicles were installed on her private property;

2. Martinelli investigators unlawfully trespassed onto Cruz’s property and installed a Spypoint Link-Dark “trail cam” on a tree located on her private property that could allegedly see into the windows of her residence; and

3. Martinelli investigators routinely ventured onto her private property to capture additional surveillance, swap out GPS tracker batteries, and retrieve SD cards from the trail cam.

It’s worth noting that in Georgia, unlike the majority of U.S. states, the use of GPS vehicle trackers by PIs is not illegal per se. Private investigators are allowed to use GPS vehicle trackers but they have to be installed when the vehicle is on public property. The fact that the PIs admitted to placing the trackers on the vehicles when they were located within Cruz’s property lines is what makes their actions problematic. Due to the amount of driving that Cruz was doing on a daily basis, the PIs ventured onto her property to swap out batteries on the GPS trackers multiple times during the three week investigation.

Cruz was able to effectively implicate both Baker Donelson and AmFam in the private investigators’ actions, in part, by discovering an email from a senior attorney at AmFam which was sent to the law firm with the following instruction for the PIs: “We need to have them do whatever they need to do to get a visual on her. Have them follow the van or do whatever else they can.” This suggests “direct involvement in a criminal scheme, not merely [a] passive role in hiring a subcontractor,” Cruz argues.

Trespass Claims

Cruz posits that the PIs trespassed on her real and personal property. In their initial depositions, the PIs attempted to justify their actions by pointing out that there were no posted “No Trespassing” signs, there were no signs that indicated entry was forbidden, and that no one confronted them or otherwise informed them that entry was forbidden.

Answering these defenses, a key distinction Cruz makes is that there is a difference between wandering onto someone’s property when going for a walk, for example, and entering someone’s property to surveil them, installing a trail cam pointed right at their house, installing GPS trackers on their vehicles (on their private property), and repeatedly returning to the private property for additional surveillance and to service said GPS trackers and a trail camera.

In this way, Cruz’s trespass claims go beyond the PIs merely entering the property, but extend to the placing of the GPS trackers on the vehicle and the other activities that occurred on her property. These actions were unlawful, and in the case of installing GPS trackers on private land, constitute felonies, according to Cruz. But aside from being criminal violations, these actions entitle Cruz to bring a civil claim—the argument goes. In February 2022, perhaps at the urging of Cruz’s counsel in an effort to bolster the “criminal” aspect of the case, the local county Sheriff’s office issued arrest warrants for three of the private investigators related to the alleged unlawful surveillance in this case.

Invasion of Privacy Claim

There is long established precedent in Georgia, as well as throughout much of the United States, that plaintiffs bringing a personal injury lawsuit necessarily expose themselves to scrutiny. For example, the Georgia Court of Appeals has held that “[by] making a claim for personal injury, [a plaintiff] must expect reasonably inquiry and investigation.” And that a plaintiff’s “right to privacy.. is waived by one who files an action for damages resulting from a tort to the extent of the defendant’s intervening right to investigate and ascertain for himself the true state of the injury.” AmFam, Baker Donelson, as well as the Martinelli defendants cite this case law to justify their actions.

However, Cruz’s answer is that there necessarily has to be a “bright line” on such activities. Specifically, a plaintiff making a personal injury claim doesn’t lose ALL rights to privacy—and even the courts have specified that investigations must be “reasonable.”

Cruz’s rebuttal reads: “For them, it is reasonable for investigators in a personal injury case to go onto someone’s property and install a camera and tracking devices that afford the defendant round-the-clock images and information that could not be gleaned from any public place. This argument invites sequential victimization of injured parties without any possibility of refuge. It is not reasonable to require injured parties to forfeit all property and privacy interests [emphasis added] to seek redress for their injuries. Baker Donelson’s argument to the contrary is radical and a marked departure from foundational norms of the civil justice system.”

Asking for Jury Trial

Cruz’s lawsuit was filed in July 2021 and so far, her case has survived multiple “Motions to Dismiss” filed by the defendants. For both the trespass and invasion of privacy claims, Cruz argues her claims deserve to be heard in front of a jury. New depositions of the private investigators and Cruz herself are now being scheduled in the Fall of 2022. With Cruz insisting on a jury trial, it will be interesting to see if this case will be tried publicly in front of a jury or if it will be settled for a confidential amount on the eve of the trial like Cruz’s last case.

A big part of Cruz’s $13 billion demand is based on her request for punitive damages from all defendants—including a demand from $12.2 billion for Am-Fam “to punish and to deter like or similar conduct.”

Lessons Learned

Isaac Peck, President of OREP Insurance, a national provider of liability insurance for private investigators nationwide, says that this case provides a good example of how things done “out of sight” often come to light. “PIs, especially those doing surveillance work, may assume that their actions or activities may never come to light—that nobody will ever ask questions. But as this case demonstrates, Cruz very quickly asked the judge for an emergency hearing and subpoenaed the PIs’ photographs and video, as well as called them in for depositions. Given the fact that the photos and video had already been turned in to the client (AmFam and Baker Donelson), even if the PIs had tried to conceal what they had done, it was unavoidable that Cruz would discover that they had trespassed on her property,” Peck points out.

Hal Humphreys, Director of Instruction at PIEducation.com and Executive Editor at Pursuit Magazine, was careful not to pass judgment when asked about the case. “It’s easy to look at a case after the fact—and hindsight is always 20/20. I wasn’t there and I want to be clear that I don’t think it’s fair for us to quarterback what was surely a difficult investigation,” Humphreys said.

Humphreys does offer some general advice for investigators as it relates to surveillance and being careful to avoid trespassing on private property. First, private investigators should always attempt to research property lines when they’re doing surveillance of a personal residence or are doing an investigation that might place them anywhere near private property. “In many cases, an investigator can go online and visit the county tax assessor’s website where the subject is located and pull up the subject’s property. In this particular case, the county assessor’s website actually shows a map that includes an aerial photo with property boundaries. It is available to the public and I didn’t have to login or register to pull it up,” says Humphreys.

So first and foremost, Humphreys recommends checking property lines. “It’s very easy to do and PIs doing surveillance work need to be mindful of it. This is especially true if you’re installing hidden cameras as part of your work, but can apply to regular surveillance jobs as well. The last thing you want is to be hit with a trespassing claim. I get heartburn about installing trail cameras on private property personally. If you’ve done the research on where the property line is, then you might be able to approach the neighbor and get permission to put a camera up. I’ve done that before and got the neighbor to send me an email granting me permission,” Humphreys says.

If you end up avoiding private property, then you might have to put something in a public right-of-way. “There are very reputable companies that can sell you cameras that look like utility boxes, fake locks, fake rocks, and so on. In my state, AT&T owns the telephone poles, so you need to be careful about that too. If you install a camera on that pole, you’re still installing it on AT&T’s private property. My personal rule is I don’t install cameras without getting permission,” Humphreys advises.

Being intimately familiar with the laws in your state is also key, according to Humphreys. “State laws can vary widely by state and GPS tracker placement is a great example of that. Depending on the type of work you’re doing, it might make sense to have an attorney you work with that you can put on some kind of retainer so they can give you legal advice. In some cases, I’ve even asked my attorney to write a letter citing case law so I’ve got some legal opinion on why it’s OK for me to do certain things, etc.,” Humphreys reports.

Lastly, Humphreys says this is an important reminder about the risks associated with the work. “My home state of Tennessee does not require PIs to carry liability insurance and many states are similar. But this is the perfect example of why I carry insurance. Even if these guys were 100 percent in the right and they win the case, they’ve been named in the lawsuit and it’s going to cost a lot to just defend it. Having insurance is absolutely key,” Humphreys argues.

About the Author

Kendra Budd is the Editor of Working PI magazine and the Marketing Coordinator for OREP Insurance Services, offering customized professional and general liability insurance solutions to private investigators and security firms. She graduated with a BA in Theatre and English from Western Washington University, and with an MFA in Creative Writing from Full Sail University. She can be contacted at kendra@orep.org or (888) 347-5273.

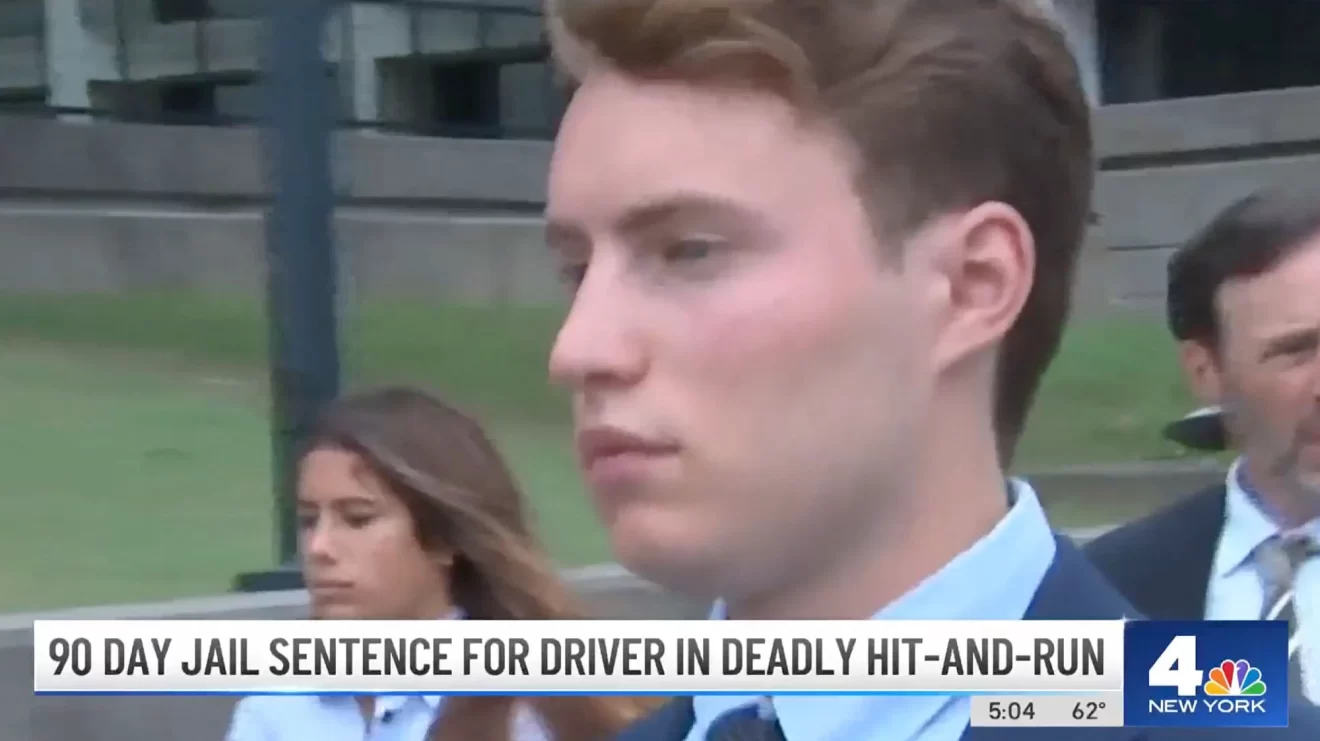

The Hamptons hit-and-run driver who mowed down an 18-year-old has been sentenced to three months in prison after the teenager’s devastated family pleaded with a judge to give him jail time.

Daniel Campbell, 20, fatally struck Devesh ‘Devu’ Samtani with his Honda Pilot on Old Stone Highway in Amagansett on August 10, 2021 with such force that he was thrown six-feet into the air. At the time, Campbell had nine other people in his car.

He’d been labeled a ‘driving menace’ after racked up a string of driving offenses, including speeding tickets days before the fatal crash, a head-on collision and even having his license stripped from him.

Campbell first pleaded guilty on August 5 to a single felony charge of leaving the scene of an accident that led to the victim’s death.

At the time, Judge Richard Ambro said he planned to sentence Campbell – whose mother owns a boutique in Montauk and whose father is an SVP at a luxury furnishings store – to six months of community service in lieu of jail time.

That decision that was met with outrage from Samtani’s parents, who traveled from Hong Kong to court hearings, urged him to reconsider.

On Thursday, Ambro sentenced Campbell to 90 days in jail, 450 hours of community service and five years’ probation.

Before being led out of the Suffolk County Criminal Court in Riverhead in handcuffs, Campbell addressed his victim’s family for the first time since the tragedy.

‘The night of the accident was a terrible tragedy. My lawyers told me not to speak for one year but, I wish I could’ve met with the family to tell them how sorry I was for ruining all of their lives. I am sorry for all the pain and devastation,’ he told Samtani’s parents.

‘I wish I could have gone to Stony Brook Hospital to see your son. There is not a day that goes by that I don’t think about the agony you have gone through. I wish I did not panic. I would give everything to change that night and to change the outcome.

I prayed every single night when he was in the hospital. You showed me what a beautiful son he was. I know the loss be with you forever. I know you may never forgive me but know how remorseful and sorry I am. I am sorry guys.’

On the night Samtani was killed, he had been walking along Old Stone Highway with his cousin Kabir Kurani, 18, and their friends trying to get service to get an Uber back home.

But he was hit by Campbell – driving a Honda Pilot packed with nine passengers – so hard he flew 6ft into the air, with his shoes flying off his feet.

Campbell then drove off and left the NYU economics student to die on the highway surrounded by his friends.

At Campbell’s sentencing on Thursday, Judge Ambro claimed he was unaware of Campbell’s three prior car accidents until he was informed by the DA’s office and Samtani’s family lawyer.

‘On September 9 I became aware of three accidents and a speeding ticket. I could no longer honor the no jail time commitment,’ he said.

He added that Campbell had declined a trial after pleading guilty in August, and the 90-day sentence was ‘fair and reasonable’.

As part of his sentence, Campbell’s licence will be revoked and he will be fined $2,000.

At least 30 members of Samtani’s family, including his parents Kishore and Mala Samtani, were in court for the hearing.

Before the sentencing, Kishore Samtani told DailyMail.com that Campbell has previously asked the judge to delay his sentencing so that he could spend Thanksgiving with his family.

‘On the 25th of August, Campbell was requesting for a delay in sentencing because he wanted to spend Thanksgiving and Christmas with his family. Thanksgiving for what? Thanking God for what … for getting off? So he will be missing one Thanksgiving and one Christmas,’ he said.

‘I heard they are upset about this and if they are upset about this what about our position.’

Kishore Samtani said he was furious that Campbell’s driving history was only uncovered after the family hired a private investigator, saying: ‘It doesn’t seem right.’

‘I am tired. We are going back. There is nothing we can do. Right. It won’t make a difference to us – one year two years. Actually, we are not happy with the system. We could afford lawyers. We could afford investigators. So we got his three months. What about the regular people?. They won’t be able to do anything,’ he said.

‘There was a lot of frustration happening in our family … We put up something, an example for other kids – come on, please don’t leave someone there dying.’

Campbell was involved in at least two crashes before the night he killed Samtani – including in February 2021 when he drove down a one way street in White Plains, New York, in the wrong direction.

It happened five months before incoming New York University freshman Samtani’s horrific death.

And just eight days prior to the fatal smash, Campbell was slapped with six points over a June 2021 speeding offense in the Bronx.

But his heedless driving history goes back to 2020 with multiple violations, including 8 points off of his license that he racked up in less than a year’s time, according to documents seen by DailyMail.com.

Celebrity lawyer Benjamin Brafman, who represents Samtani’s devastated family, told DailyMail.com in September: ‘One of the accidents he was involved in was a head-on collision with another vehicle on a road that was clearly marked one-way.

‘He was headed in the wrong direction. It was a miracle that no one was killed or hurt.’

Speaking about Campbell himself, Brafman added: ‘We describe him as a driving menace.’

As well as the previous collisions and speeding tickets, Campbell was handed two points on his license in May 2021 for disobeying traffic devices in the town of Brookhaven, Suffolk County.

He was also fined a total of $184 for driving an uninspected and unregistered vehicle in November 2020 in Westchester County.

Campbell was seen working at his mother’s Montauk boutique, Bontemps in the months before his sentencing. He and his family lives part-time in area, with their primary residence in Hastings-on-the-Hudson in Westchester County.

The family-owned store, which opened in spring of 2021, is a beach clothing store that sells hoodies, sandals, hats, beach bags and sunglasses among other items, which has generated close to a million dollars in annual sales, public records show.

Campbell’s father, Daniel Campbell, 51, is the SVP of a modern luxury furnishings firm, that he has been with for more than 17 years, according to his Linkedin profile.

His mother Gretchen Smith Campbell, 52, told DailyMail.com that she ‘had no comment’ when asked about the details surrounding the night of the crash.

In March 2021, Daniel Boice, CEO and founder of Trustify, was sentenced for his orchestration of a $18 million investment fraud scheme. Boice was sentenced to 97 months in jail followed by 3 years of supervised release. He was also ordered to pay $18.13 million in restitution and $3.7 million in forfeiture–sums that many have suggested he will never be able to repay.

Trustify, a company which Boice founded in 2015, was heralded as the “Uber of Private Investigators.” Boice claimed that he was inspired to start the company after his recent divorce and his vision was an Uber-style website and phone application that consumers could use to hire private investigators with the push of a button.

Boice raised more than $18 million from over 250 individual and corporate investors and in a very Uber-esque style, Trustify lost money. But more importantly, Boice was able to raise funds from investors by fabricating Trustify’s financial statements, severely inflating Trustify’s revenue and performance, lying about corporate business relationships, and even pretexting! According to a Department of Justice press release, Boice created a fake email account and posed as a prominent potential investor–subsequently emailing an investment firm and successfully convincing them to invest nearly $2 million in Trustify.

Boice diverted much of the company’s assets for his personal expenditures, including flying on private jets, expensive mortgages on two homes, jewelry, Caribbean vacations, and his own extravagant wedding to his second wife. Former employees allege in a lawsuit that he used $600,000 of company funds to make a never-completed documentary about himself and his then-wife. The total funds diverted to his personal expenditures is estimated by the Securities and Exchange Commission to be close to $8 million.

While Trustify did actually perform some legitimate business, its model was built on relatively low wages for private investigators and it struggled to find high-quality investigators willing to work for $30 per hour. This led, in part, to Trustify spending heavily on advertising. Critics pointed out that this was way under market value.

Additionally, if you can hire a private investigator with the push of a button, who is vetting the client? What if a sexual predator or stalker used the app to collect data on a potential victim? The many nuances, dangers, and risks involved in the private industry seemed to be brushed over by this Uber model. These were the challenges that Trustify struggled with.

Some experienced, veteran private investigators long suspected that Trustify didn’t have a functional business model and predicted its demise–but perhaps few realized just what a scam it actually was.

By November 2018, Boice stopped paying his employees and then promptly fired them all right before Thanksgiving. Already facing lawsuits and collection calls regarding unpaid rent and bills due, this final action set off warning bells for the rest of his investors and a series of lawsuits followed. A firm that invested over $6 million in Trustify argued that Boice “made Trustify ‘go dark,’ evading and outright ignoring…repeated requests for information.”

Even in the face of an imploding business and investor lawsuits, Boice penned an article published by Medium in Spring 2019 titled “Trust, but Verify”–perhaps serving as the pinnacle of his gaslighting delusion.

His own staff sued him for unpaid wages and alleged that he had spent $600,000 on a documentary about himself and his then wife. When he was court-ordered in court to pay his staff back and resign from Trustify, he moved to Florida, started calling himself Keith, and got a job with a medical software company which is now also suing him for fraud and theft.

Before he was finally arrested and charged with fraud, Boice claimed that he was the victim of a “seek and destroy mission conducted by a group of old white male one percenters and their silver spoon trust fund inheriting lackeys.”

Ultimately, the “Uber for Private Investigators” ended in disaster. It is pure irony that the founder an app for private investigators “on demand” should’ve been investigated himself–an irony that is perhaps most appreciated by Trustify’s investors.

Sentencing Boice to eight years in prison, Judge T.S. Elliss III said: “It would be difficult to describe the havoc you created by your fraudulent actions. It’s an egregious fraud.”

For his part, Boice said: “I accept full responsibility, I make no excuses, no justification, and I am truly, truly remorseful.”

Facebook has for years struggled to crack down on content related to what it calls domestic servitude: “a form of trafficking of people for the purpose of working inside private homes through the use of force, fraud, coercion or deception.

The company has known about human traffickers using its platforms in this way since at least 2018, the documents show. It got so bad that in 2019, Apple threatened to pull Facebook and Instagram’s access to the App Store, a platform the social media giant relies on to reach hundreds of millions of users each year. Internally, Facebook employees rushed to take down problematic content and make emergency policy changes avoid what they described as a “potentially severe” consequence for the business.

But while Facebook managed to assuage Apple’s concerns at the time and avoid removal from the app store, issues persist. The stakes are significant: Facebook documents describe women trafficked in this way being subjected to physical and sexual abuse, being deprived of food and pay, and having their travel documents confiscated so they can’t escape. Earlier this year, an internal Facebook report noted that “gaps still exist in our detection of on-platform entities engaged in domestic servitude” and detailed how the company’s platforms are used to recruit, buy and sell what Facebook’s documents call “domestic servants.”

Last week, using search terms listed in Facebook’s internal research on the subject, this author located active Instagram accounts purporting to offer domestic workers for sale, similar to accounts that Facebook researchers had flagged and removed. Facebook removed the accounts and posts, and spokesperson Andy Stone confirmed that they violated its policies.

Whistleblower Frances Haugen testified before the Senate Commerce Committee’s consumer protection subcommittee.

“We prohibit human exploitation in no uncertain terms,” Stone said. “We’ve been combating human trafficking on our platform for many years and our goal remains to prevent anyone who seeks to exploit others from having a home on our platform.”

The Apple threat, first reported by WSJ last month, represents the potentially dire consequences of Facebook’s continued challenges with moderating problematic content on its platforms, especially in non-English-speaking countries. In one SEC complaint related to the issue, representatives for Haugen wrote: “Investors would have been very interested to learn the truth about Facebook almost losing access to the Apple App Store because of its failure to stop human trafficking on its products.” The revelation also comes as tensions between Facebook and Apple have risen in recent months over user privacy issues.

Stone directed viewer’s attention to a letter Facebook sent last summer to several United Nations representatives about its efforts to combat human trafficking on its platform. In the letter, the company notes that domestic servitude content is “rarely reported to us by users.”

“To counter these challenges … we have also developed technology that can proactively find and take action on content related to domestic servitude,” Facebook said in the letter. “By using it, we have been able to detect and remove over 4,000 pieces of violating organic content in Arabic and English from January 2020 to date.”

Facebook has tried to discredit some earlier reporting by the Wall Street Journal and Haugen’s testimony to a Senate subcommittee earlier this month. In a tweet last week ahead of “The Facebook Papers” publication, Facebook Vice President of Communications John Pinette said: “A curated selection out of millions of documents at Facebook can in no way be used to draw fair conclusions about us.”

A ‘severe’ risk to Facebook’s business

In the fall of 2019, Facebook was approached about an investigation it was soon to publish about an illegal online marketplace for domestic workers — which operated in part using Instagram — and shared the hashtags it had used to locate the content, according to an internal Facebook report. In response, Facebook removed 703 Instagram profiles promoting domestic servitude, but “due to the underreporting of this behavior and absence of proactive detection,” other domestic servitude remained on the platform, the report states.

Following the publication of the BBC investigation, Apple contacted Facebook on October 23, 2019, threatening to remove its apps from the App Store for hosting content that facilitated human trafficking. In a November 2019 internal document titled “Apple Escalation on Domestic Servitude — how we made it through this [Site Event]” a Facebook employee detailed the actions the company took over the course of a week to mitigate the threat, including taking action against more than 130,000 pieces of domestic servitude-related content in Arabic on Facebook and Instagram, expanding the scope of its policy against domestic servitude content and launching proactive detection tools in Arabic and English.

“Removing our applications from Apple platforms would have had potentially severe consequences to the business, including depriving millions of users of access to IG & FB,” the document states. “To mitigate against this risk, we formed part of a large working group operating around the clock to develop and implement our response strategy.”

Despite the scramble during that week, Facebook had been well aware of such content before the BBC reached out. “Was this issue known to Facebook before the BBC enquiry and Apple escalation?” the internal report states, “Yes.”

In March 2018, Facebook workers assigned to the Middle East and North Africa market flagged reports of Instagram profiles dedicated to selling domestic laborers, internal documents show. At the time, these reports “were not actioned as our policies did not acknowledge the violation,” a September 2019 internal report on domestic servitude content states.

Stone, the Facebook spokesperson, said the company did have a policy prohibiting human exploitation abuses at the time. “We have had such a policy for a long time. It was strengthened after that point,” he added.

Internal Facebook documents show that Facebook launched an expanded “Human Exploitation Policy” on May 29, 2019 that included a prohibition on domestic servitude content related to recruitment, facilitation and exploitation.

In September 2019, a Facebook employee posted to the company’s internal site a summary of an investigation into a trans-national human trafficking network that used Facebook apps to facilitate the sale and sexual exploitation of at least 20 potential victims. The criminal network used more than 100 fake Facebook and Instagram accounts to recruit female victims from various countries, and used Messenger and WhatsApp to coordinate transportation of the women to Dubai, where they were forced to work in facilities disguised as “massage parlors,” the summary said.

The investigation identified $152,000 spent to buy advertisements on its platforms related to the scheme, including ads targeting men in Dubai. The company removed all pages and accounts related to the trafficking ring, according to the report. Among the recommended “action items” listed for response to the investigation is a request that Facebook clarify policies for how it handles ad revenue associated with human trafficking to “prevent reputational risk for the company not to profit from ads spent for HT.

About a week later, a subsequent report outlined more broadly the issue of domestic servitude abuse on Facebook’s platforms. The document includes samples of advertisements for workers posted to Instagram; one describes a 38-year-old Indian woman for sale for the equivalent of around $350.

Ongoing challenges

More recent documents show that despite efforts Facebook took to remove such content immediately and in the weeks and months following the Apple threat, it has still struggled to regulate domestic servitude content.

Andy Stone’s aggressive communications strategy appeals to Facebook chief operating officer Sheryl Sandberg (left) and founder and CEO Mark Zuckerberg (right), insiders say.

A report distributed internally in January 2020 found that “our platform enables all three stages of the human exploitation lifecycle (recruitment, facilitation, exploitation) via complex real-world networks,” and identified some commonly-used naming conventions for domestic servitude accounts to help with detection. Traffickers from labor “recruitment agencies” used “FB profiles, IG Profiles, Pages, Messenger and WhatsApp to exchange victims’ documentation … promote the victims for sale, and arrange buying, selling and other fees,” the document said of one trafficking network the company identified.

In a February 2021 report, researchers found that often labor recruitment agencies communicated with victims via direct messages but rarely posted post public content violations, making them difficult to detect. The report also said Facebook lacks “robust proactive detection methods … of Domestic Servitude in English and Tagalog to prevent recruitment,” although the Philippines is a top source country for victims, and that it didn’t have detection capabilities turned on for Facebook stories. The report laid out plans for a preventative educational campaign for workers, and said researchers identified at least 1.7 million users who could benefit from information about workers’ rights.

Facebook kept its own oversight board in the dark on program for VIP users.

“While our previous efforts are a start to addressing the off-platform harm that results from domestic servitude, opportunities remain to improve prevention, detection, and enforcement,” the February report stated. The company has implemented on-platform interventions to remind people seeking employment of their rights, and has information on its Help Center for users who encounter human trafficking content, Stone said.

Although Facebook researchers have heavily investigated the issue, domestic servitude content appears to still be active and easily found on Instagram. Using several common account naming trends highlighted in one domestic servitude internal research document, last week we identified multiple Instagram accounts purporting to offer domestic workers for sale, including one whose account name translates to “Offering domestic workers” that features photos and descriptions of women, including their age, height, weight, length of available contract and other personal information. Facebook confirmed these posts violated its policies and removed them after they were encountered.

In early 2021, Facebook launched “search interventions” in English, Spanish and Arabic that create “friction” in search when users “type in certain keywords related to certain topics (that we have vetted with academic experts),” according to Stone. He added that the company launched these search interventions for sex trafficking, sexual solicitation and prostitution in English, and for domestic servitude and labor exploitation in Arabic

“Our goal is to help deter people from searching for this type of content,” Stone said. “We’re continuing to refine this experience to include links to helpful resources and expert organizations.”

Savvy investigators can detect fraud and prosecute suspects using certain insurance fraud indicators. Just as every poker player has a “tell,” investigators search for a fraudster’s tell—an indication that a consumer, provider, insurance company, or adjuster is attempting insurance fraud.

Fraud indicators don’t automatically indict a person or give a company legal basis for denying a claim. Instead, they initiate an investigation in the alleged fraud. It’s important to know common insurance fraud indicators to avoid triggering a full-scale investigation during a legitimate claim.

Property Damage Doesn’t Match Injuries

In insurance fraud based on personal injury, the claimant’s alleged injuries often don’t match the amount of vehicle property damage. For instance, a woman claiming whiplash in a rear-end collision with no more than a vehicle scratch might alert the claims adjuster to fraud. If the damages to a vehicle are minor enough to lower the likelihood of any occupant sustaining an injury, it’s likely an attempt at fraud.

History of Prior Claims

If a claimant has a long history of prior car accident or personal injury claims, it could be a pattern of fraudulent activity. A common example is a person whose history of claims has increasingly greater values. This shows the perpetrator is testing the system to see how much money he or she can steal without getting caught. In these cases, the perpetrator’s first claim may have been legitimate. The claimant realized how easy it was to “milk the system” and started making fraudulent claims.

Situational Clues

Good investigators know to look for certain fraud indicators in a claimant’s recent and ongoing situational clues. If a claimant recently declared bankruptcy or filed a substantial financial loss, for example, it could give the person a motive for insurance fraud. Another red-flag situation is if the claimant recently purchased a new insurance policy. Claims managers know to look for this as an immediate sign of fraud and will likely put an investigator on the case right away.

Familiarity with the Claims Process

Although it’s not unusual for a person to be familiar with the accident claims process, especially those in repeat accidents, he or she shouldn’t be too familiar. If a claimant is overly knowledgeable about the insurance process, lingo, terminology, and standard procedures, it’s a sign that he or she has done this too many times before or has researched what to say.

Different Versions of What Happened

Any major discrepancies in two peoples’ accounts of the same accident are going to set off an alarm. If two drivers dispute how many people were in a vehicle at the time of the crash, for example, or if one driver says no crash happened at all, these are indicators of fraud. Truthful claimants will have the same or at least a similar version of the accident as the other driver.

Evident Falsification of Injuries

If a claimant waits an abnormally long time after an accident to see a doctor for injuries, it’s a sign that he or she didn’t sustain the injury in the crash. Often, a fraudster might use an old car accident to receive a settlement check for a new injury. Other signs of this type of fraud are medical documentation or lost wage forms that appear falsified.

Insurance fraud is a serious allegation—one that upon conviction can lead to felonies, prison sentences, and civil penalties. Insurance companies can prosecute anyone they suspect of using false information or intentionally deceiving a claims adjuster during the claims process. While many believe insurance fraud is a victimless crime, it costs society billions of dollars every year.

Statistics say that 85% of women who feel their lover is cheating are correct and 50% of men who feel their lover is cheating are right. If you have suspicious, consider some of the following and be as impartial as possible.

Have you noticed a:

- Sudden increase in time away from home

- Decreased sexual interest with you.

- Cheating spouse is often distracted and day dreaming.

- Cheating husband or wife is often “unavailable” while at work.

- Cheating spouse attends new functions outside of work or not wants to go alone.

- Cell phone calls from you are not returned in timely fashion.

- Cheating spouse leaves house or goes to other rooms to talk on the telephone.

- Cheating spouse uses computer alone and secretly.

- Cheating spouse asks about your schedule more often than usual.

- Mileage on car is high yet he / she reports only short distance errands.

- Clothes smell of perfume or cologne.

- Cheating spouse gets his / her laundry done independently.

- Unexplained payments on bank statements.

- Cheating spouse has more cash on hand without accountability.

- Cell phone bills contain calls with long duration.

- Cheating spouse now has a phone card but never used one before.

- Cheating wife or husband has unexplained receipts in wallet or purse.

- Cheating spouse has suspicious phone voice-mail messages.

- Cheating spouse has suspicious cell phone numbers stored or dialed.

- Internet web browser history list (this is a record of web sites visited) contains unusual sites.

- Cheating spouse begins to use new or free e-mail account.

- Cheating spouse is suddenly deleting e-mail messages.

- You may also want to consider reviewing your spouse’s credit card bills.

Why is it important to investigate a traffic accident? It was just an accident, right? In a 2014 study completed by the National Highway Transportation Safety Administration (NHTSA), the economic cost of traffic accidents in the United States (based on 2010 data) was $871 billion.

The study, published on the NHTSA website and by USAToday, reports an economic loss of $277 billion. That’s about $900 for every person living in the United States. Societal harm from loss of the quality of life and from pain and suffering associated with injuries was $594 billion.

In 2014, the NHTSA reported 29,989 fatal accidents with 32,675 fatalities nationwide. Each state reports the number of people killed each year and the number of fatal accidents. 2014 saw a range of fatalities from 3,538 in Texas to 23 in the District of Columbia.

Other than the economic loss associated with traffic accidents, there are other reasons to investigate an accident. Those involved – family, friends, and associates – want to know what happened to their loved ones. Insurance companies are interested so they can assign fault. Government agencies such as NHTSA, the National Transportation Safety Board (NTSB), Department of Transportation (DOT), and so on, want to know so they can make the roads safer or to identify issues with vehicles, roadway design or signage. Safety experts from automobile companies and consumer’s groups want to know what can be done to make transportation safer and ensure the safety of the consumer.

In the context of traffic accidents, the term accident has become a misnomer. An accident is defined as an unintentional act. There is no fault but for some unknown reason, forces of the universe have met at a certain point in time and place, and a result occurred. As defined by The American Heritage Dictionary of the English Language, fourth edition, an accident is “an unexpected and undesirable event, especially one resulting in damage or harm”. It is an unforeseen incident that happens completely by chance, with no planning or deliberate intent.

Increasingly the term crash is being used to describe the impact of a traffic unit with an object. An accident implies liability – that is, something could have been done to avoid the accident. When objects crash – here, “crash” is a verb – they collide violently against something with great force, causing damage or destruction. As a noun, a crash expresses an act or an occurrence.

When investigators investigate a traffic accident, they are trying to tell a story. It’s a story of how and why the accident occurred and what caused the damage or injury. If you are an investigator, when speaking to a judge or jury, don’t try to talk above them. Watch for the deer-in-the-headlights look. Remember, a juror typically has about an eighth-grade education.

Remove the “CSI Effect”. Traffic accidents cannot be investigated in forty-seven minutes. Some traffic accidents cannot be investigated at all, because everything has been moved, and there are no photographs, measurements, and so on.

Human, Mechanical, Environmental

A traffic accident is a highly involved, complex interaction between two objects. It may include a series of events that led up to the conclusion of the accident. It is not simply a car hitting another object.

All traffic accidents occur due to three major contributing elemental factors:

- Human factors

- Vehicular factors

- Environmental factors

Human Factors

Human factors are the human elements involved in a traffic accident, including drivers, passengers, and outside individuals. What the participating individuals were doing, or not doing, before the event should be addressed.

When looking at impairment, keep in mind that this is not limited to alcohol or drugs. Impairment may also include fatigue, mental or emotional stress, or other contributing human factors from passengers, pedestrians, or bicyclists, as well as from driver education, training, and experience.

Vehicular Factors

Vehicular factors are those associated with vehicular defects and malfunctions of the vehicle’s system components. This includes, but is not limited to, braking, steering, suspension, visibility, and lighting.

Environmental Factors

Environmental factors are those associated with the environment surrounding the vehicles. This includes the roadway, signs and markings, weather, lighting, other vehicles, pedestrians and animals (both domestic and wild).

Information about all three factors must be gathered, addressed, documented, and most importantly, properly interpreted, based on fact and reason, not emotion or suspicion.